First Take on the 2025 Gartner Magic Quadrant™ for Customer Data Platforms (CDPs)

The 2025 Gartner Magic Quadrant™ for Customer Data Platforms (CDPs) finally dropped on Tuesday, March 25, 2025.

Although it's not publicly available yet, I had the chance to review a copy and like another popular industry report, the 2024 Forrester ESP Wave™, it’s filled with a mix of valuable insights, conspicuous omissions, and some eyebrow-raising conclusions (Read my thoughts on previous report at First Take on the 2024 Forrester Email Marketing Services Providers Wave™).

Ever since CDP mania took over the martech landscape in 2020, I’ve followed the category closely, expanding our RFP services at Email Connect to include CDP evaluations.

Full disclosure: I have a bit of history with Gartner regarding CDPs and ESPs. Our story begins back in December 2019. At the time, Gartner wasn’t exactly bullish on CDPs, predicting that by 2025, 80% of marketers who invested in personalization would abandon their efforts due to a lack of ROI, customer data management challenges, or both.

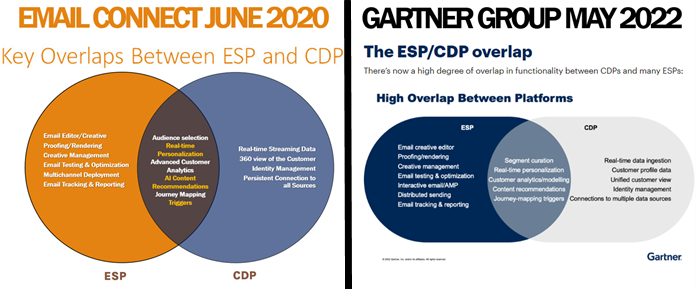

Just a few months later, I was likely the first to publicly highlight the functional overlap between CDPs and ESPs—in a speech at the 2020 Email Innovations World and later in a blog post here on Only Influencers (OI). That speech and post included a Venn diagram (below left) illustrating this convergence.

Two years later, in 2022, Gartner adopted a suspiciously familiar diagram (bottom right) in their own analysis.

Thoughts on the Magic Quadrant

I completely agree with Gartner’s description of the mandatory features a platform must offer to be considered a CDP. And Gartner’s selection of CDPs in the Magic Quadrant is solid, featuring a mix of marketing cloud solutions and standalone platforms. However, the omission of a truly composable CDP like Hightouch or RudderStack is a glaring oversight.

While Hightouch may not yet meet Gartner’s revenue criteria, its rapid growth and unique model of activating customer data directly from existing data warehouses (such as Snowflake, BigQuery, and Redshift) warrant serious consideration. Unlike traditional CDPs that focus on data storage and identity resolution—such as Twilio, Treasure Data, and Adobe Real-Time CDP—composable platforms offer companies greater flexibility and efficiency by leveraging their existing infrastructure.

Another issue I have with the report is its apparent bias in favor of marketing cloud platforms. Adobe, Salesforce, and Oracle all have significant drawbacks, particularly for companies not already embedded within their ecosystems. Their limitations in third-party integration and interoperability are well-documented in the report, yet these shortcomings don’t seem to have impacted their rankings as much as they should have.

I was also surprised by Zeta’s placement, but for the opposite reason be, because it is ranked too low. Unlike the traditional marketing cloud CDPs, which required users to stitch together multiple components (e.g., Adobe Experience Platform, Adobe CDP, and Adobe Journey Optimizer), Zeta’s CDP is natively integrated within the ZMP, offering full CDP and ESP functionality in a single platform. Given this seamless functionality, Zeta deserved a much stronger ranking. Similarly, I would have placed Amperity higher. While Gartner expresses caution over its management turnover and company stability, no platform matches Amperity’s ability to probabilistically link records—a critical feature in modern data unification.

CDP/ESP Overlap: A Missing Conversation

One of the biggest surprises in Gartner’s analysis is the complete omission of the overlap between CDPs and ESPs. To be fair, Forrester has also sidestepped this issue, though their research tends to support the trend of integrating CDP capabilities within broader marketing platforms, including ESPs. However, this blind spot in both Gartner’s and Forrester’s reports is significant.

The biggest challenge for standalone CDPs isn’t just competition—it’s the growing realization that standalone platforms may not be the answer for many marketing functions. Several CDPs are struggling to stay afloat, and buyers continue to question their ROI. In five years, will standalone CDPs still exist, or will their functionality simply become an embedded feature of ESPs, CX platforms, and other martech systems? As I wrote in a recent OI blog post, much of what brands sought in a CDP is now built directly into next-generation ESPs that leverage NoSQL databases, handling customer data aggregation, segmentation, and activation without requiring a separate CDP.

Or as Paul Shriner, co-founder at AudiencePoint, recently said “"CDPs have become the ultimate band-aid for outdated martech stacks. Instead of fixing the underlying problem—aging ESPs and fragmented data systems—brands are layering on CDPs to patch the gaps. The real solution isn’t another platform; it’s rethinking how data flows across the entire ecosystem."

Conclusion

If you ignore the rankings (and you probably should), there’s still plenty of valuable information in Gartner’s Magic Quadrant. Their platform descriptions and analyses are mostly accurate, even if I disagree with some of their conclusions. However, marketers evaluating standalone CDPs must weigh their options carefully against their ESP’s existing capabilities (or lack thereof). It’s no coincidence that marketing cloud vendors with aging ESP technology are aggressively pushing CDPs to compensate for functionality gaps that modern ESPs manage out of the box.

From an IT perspective, I understand the appeal of a dedicated platform. But if security concerns mean you don’t want to replicate customer data outside your firewall, a composable CDP should absolutely be part of your evaluation. If Gartner’s Magic Quadrant is your guide, be sure you’re considering all the options—including those Gartner overlooked.

Photo by Josh Blanton on Unsplash

Photo by Josh Blanton on Unsplash

How to resolve AdBlock issue?

How to resolve AdBlock issue?