Engagement Levels of Email Acquisition Sources

There are dozens of sources, methods, and tactics to grow your email subscriber list, and we all know that not all of them are equally effective. Marketers have vague notions that organic list growth is best and paid acquisition of sources may yield lower quality subscribers, but there is little data available that gets at the validity of that assumption. I pulled some data from my own subscriber list to help throw some hard data into the mix.

One of my goals in audience development at FierceMarkets, a digital B2B news media company, is to focus on adding active subscribers who open, click, and engage with our newsletters and client campaigns. The main way I judge quality of subscriber source is looking at open and click reach – that is, the percentage of subscribers who have opened or clicked any of our mailings in the past three months – by source.

I usually put more weight on open reach than click reach when I’m doing this type of analysis on FierceMarkets lists. We print the full text of each news article in our newsletters, so we have a lot of subscribers who interact with our content without clicking on anything. It’s possible for a subscriber to read every word of our news articles without leaving their inbox, so open reach is a more meaningful metric for us. The most meaningful metric for your company may be click reach or number of purchases or number of downloads or something completely different – just make sure it aligns with your business interests.

I’m going to focus this analysis on four of our top subscriber sources. Most of the new FierceMarkets newsletter subscribers join our lists organically by signing up through one of our websites, so I’ll include that source in the analysis. I’ll also include subscribers we gain by marketing to external lists, by using coregistration vendors, and by advertising through pay-per-click (PPC). I limited the data set to subscribers who joined our lists within the last two years, which is a large enough sample size to be statistically significant.

My initial assumption was that the subscribers who signed up via organic channels would be most active by far. I expected the subscribers from external marketing would be a distant second, follow by PPC, and the subscribers from coregistration vendors would be the least responsive.

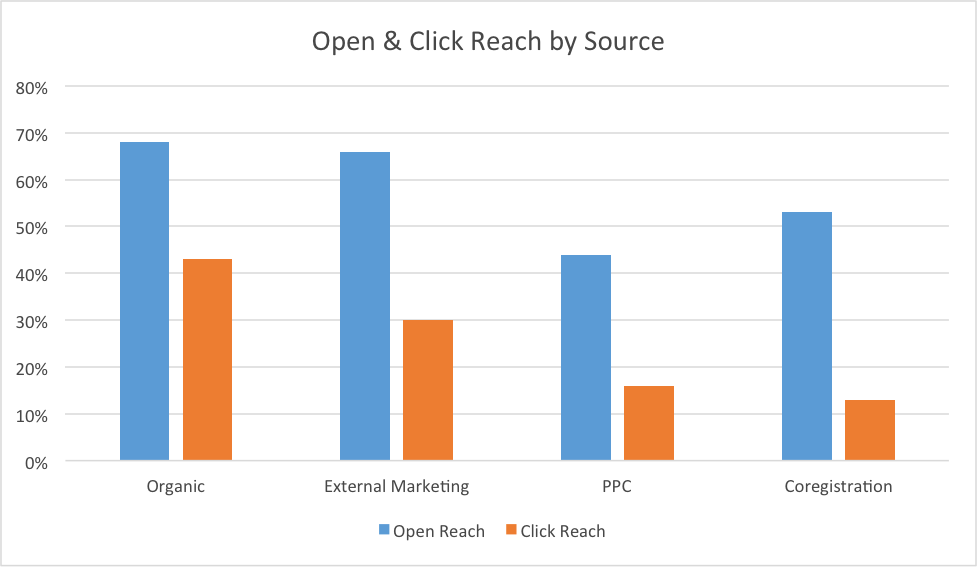

Here’s how the analysis actually turned out.

I was most surprised to see how similar open reach levels were for organic subscribers and subscribers from external marketing, which had a 68% and 66% open reach, respectively. Most of the external marketing we do is through industry organizations, associations, and event companies. We work through the organizations and have them send out email blasts inviting list members to subscribe to a relevant FierceMarkets newsletter, so all of the subscribers we receive from these efforts are opt-in. It makes sense that these subscribers would be active readers of our publications, but I hadn’t realized just how active. It is interesting to note that while organic and external list open reaches are similar, the click reaches were a bit more spread apart at 43% and 30%, respectively.

I was also surprised to see that subscribers from coregistration had a higher open reach (53%) than subscribers from PPC (44%). The PPC signup process is more closely tied to our newsletter brands and gives us a chance to give more information about each newsletter than the coregistration vendor process, so I assumed subscribers who joined our lists through PPC would be more active. That theory held fairly true for click reach, in which PPC subscribers scored 16% and coregistration subscribers scored 13%, but not for open reach.

As with so much in email marketing, this is yet another study that proves data doesn’t always align with gut. Open and click reach may not be the most meaningful or descriptive metrics for your specific company, but determining the metric(s) that are most meaningful can be a powerful data point to help guide your marketing decisions.