2023 State of the ESP RFP Survey Results and Conclusions

This is the third year that Only Influencers and Email Connect have conducted a brief survey with brands regarding their plans to switch vendors in the upcoming year. The survey was originally intended to measure the impact that COVID-19 had on brands’ plans to conduct ESP RFPs in 2020—2022. What we saw in the first 2 years was that a lot of RFPs were put on hold, leading to an upsurge in late 2021 and into 2022.

By the middle of 2022, the COVID-related surge in RFPs was coming to an end. However, a new trend appears to have had a growing impact on brands’ decisions as to whether or not they would RFP at the end of their existing contract. This trend—the “Changing of the Guard”—was something I first wrote about in a November 2021 Only Influencers blog post. I wrote, “… old established legacy ESPs are facing new competition from a number of upstart ESPs, who until recently, did not compete much in the enterprise space. That has started to change over the last couple of years… The new wave of “next gen” ESPs are again seen by many email marketers as being more innovative and leading the way in new features and functionality.”

Evidence of this trend can be seen in two ways. First, the rate of RFPs does not appear to have diminished, and in fact, might be increasing. And second, when we culled through the responses this year to the question, “Which 3 vendors would you be sure to include in an RFP?”, the most frequently cited ESPs, by and large, fall under the “next gen” label. Most legacy platforms were well down the list in terms of mentions.

About the Survey Respondents

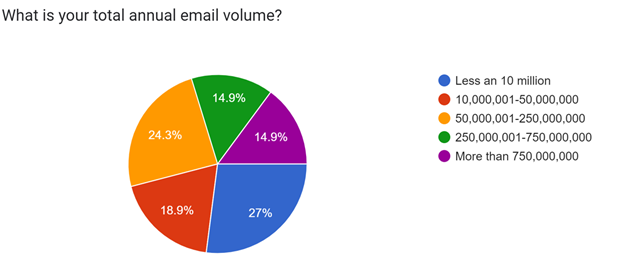

This year, we got a really good mix of companies responding to the survey. Brands ranged in size from the top of the SMB category all the way up to enterprise-sized email volumes. We received a higher percentage of responses from brands in the 3 highest volume categories vs. previous years, which makes our findings that much more relevant to enterprise and mid-market ESPs. This chart shows how they break out by email volume:

The range of email volumes is valuable as it allows us to see where the volume of email has an impact on attitudes and needs.

To RFP or Not to RFP

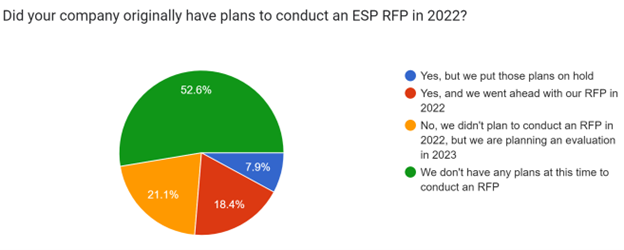

As we begin 2023, we see that fewer RFPs were put on hold the previous year than we saw at this time last year. 7.9% of respondents put an RFP on hold in 2022 vs. 16.3% who put an RFP on hold in 2021. This would appear to indicate that the COVID pandemic is having a decreasing impact on brands’ plans to conduct an RFP. And the cause of an RFP postponement in 2022 could just as likely have been the result of an uncertain economic environment.

The percentage of respondents who reported that they are planning an evaluation in 2023 increased this year to 21.1% from 16.3% in last year’s survey. We believe that that increase is more a reflection of the aforementioned “Changing of the Guard” than it is pandemic related.

How are you Approaching your Vendor Evaluation in 2023?

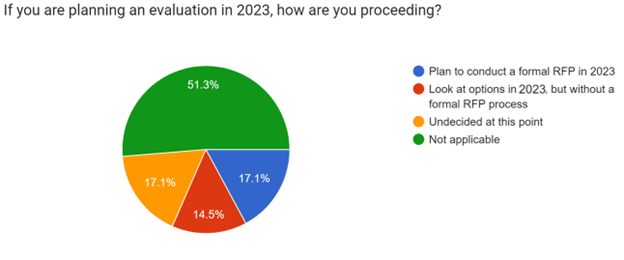

Planning for formal RFPs is up in 2023 (17.1%) vs. 2022 (10.3%), in line with the increasing number of evaluations this year. While also up in 2023, a smaller percentage of respondents plan on evaluating their options without a formal RFP process (14.5% vs. 5.1%)

Enterprise brands are far more likely to be planning formal RFPs, while the smaller volume senders are more likely to evaluate without a formal RFP. This is not surprising at all given the complexity of larger brands’ email programs and the big differences between enterprise ESPs.

What is the Primary Driver of your RFP?

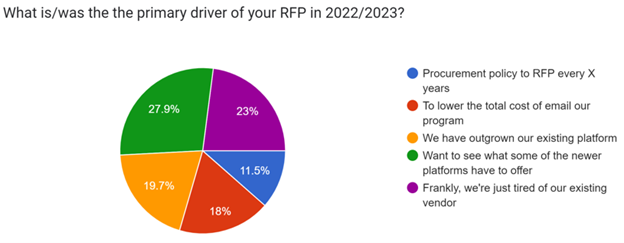

Once again in the answers to this survey question, we see evidence that a “Changing of the Guard” is not only taking place, it’s accelerating. The #1 reason brands gave for going to RFP in 2023 was, “Want to see what some of the newer platforms offer”, totaling 27.9% of responses, up from 20.6% in our last survey. Coming in second was, “sick of our old vendor”, with an increase of several points from 17.6% to 23%.

Much of those gains came from the more traditional reason, “We have outgrown our existing platform”, which fell to 19.7% this year from 38.2% in 2022.

As we move into 2023, the two reasons that have long dominated RFP decisions, Procurement Mandate at 11.5% and Lowering Costs at 18%, collectively influence only around a third of decisions to RFP.

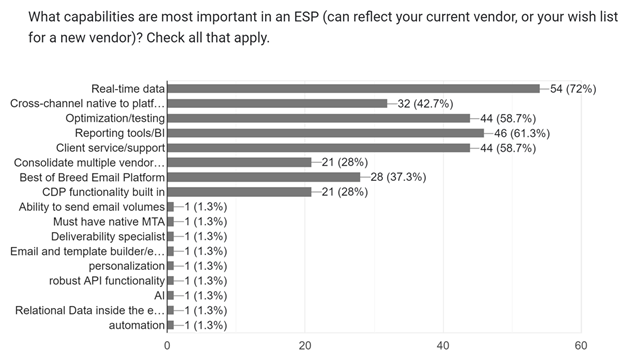

What capabilities are most important in an ESP?

In perhaps the most significant shift this year, “Reporting tools/BI”, which had topped the list in both previous surveys, drops to second place at 63.1% this year behind “Real-time data” which was listed by 72% of respondents. What accounts for its move up from 4th place last year? It’s our belief that one of the results of the collision of CDPs and ESPs, which we wrote about here, is a greater appreciation of, and demand for, real-time data for email campaigns. That’s one of the core promises of CDP platforms, and those ESPs that are architected like CDPs.

“Client service/support” and “Optimization/testing” both remained highly desirable capabilities this year, tying for 3rd at 58.7%.

Hot or Not

If there was any question that supports the concept that there is a changing of the guard in the ESP landscape, it was which ESPs the respondents said they would be sure to include if they were starting an RFP tomorrow. Next gen platforms like Iterable and Braze continued to get a lot of mentions but they were joined this year by other next gens Zeta Global and Cordial (kudos to the marketing teams at both ESPs!). And before you say, “but isn’t Zeta a legacy platform?” -- its ZMP is only a few years from launch and built from the ground up.

There remains (at least among our survey respondents) a distinct lack of enthusiasm for many of the legacy platforms, other than Salesforce Marketing Cloud. When it comes to the category I call “Cheap and Cheerful” ESPs, Klaviyo continues to receive the most mentions by a wide margin.

Continuing a trend seen in the last two surveys, the mix of platforms mentioned by many respondents indicates there still is a lot of confusion around who to include in an email RFP based on brand size and volume. It’s probably not a good idea to include MailChimp and Zeta (as one respondent did) in the same RFP. One of them is either way too big, or way too small for your needs. Picking the wrong ESPs to evaluate is the #1 cause of RFP failure. Brands need to do their homework before starting an evaluation.

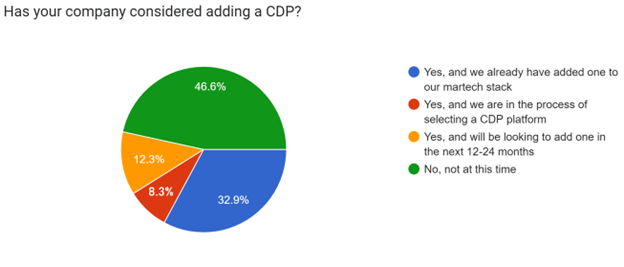

Where do CDPs Fit in the Picture?

Responses to this question remained remarkably similar between this year and last. In both years, just under 50% of respondents replied that their company had no plans to add a CDP at the moment. And a little over 50%, have one, are in the selection process, or are going to conduct a selection process in the next 12-24 months.

As the dividing line between CDPs and ESPs continues to blur, answering this question becomes more and more complicated! Deployment CDPs like Simon and Blueshift are winning ESP evaluations, while ESPs like Cordial continue to be considered CDPs by industry analysts like the Customer Data Platform Institute. In any event, ESP evaluations must be made within the context of a company’s near-term plans as to whether or not to add a CDP, or whether one is already in place. But that’s a topic for another blog post!

Summary of Findings

1. The impact of COVID-19 on the timing of RFPs has, by and large, ceased to be a factor.

2. Interest in conducting RFPs going into 2023 continues to be very high among brands, but the push toward it is coming from the “changing of the guard” rather than delayed COVID RFPs.

3. Brands planning on conducting evaluations are increasingly planning on formal RFPs, which is perhaps an acknowledgment of the importance of “getting it right”.

4. Real-time data has jumped to the head of the line regarding what brands look for most in a new ESP, but the continuing importance of client service/support should not be ignored by vendors.

5. SFMC is the top-of-mind legacy ESP appealing to brands across all levels of email volume; matched by “next gen” platforms Iterable, Braze, Cordial, and Zeta Global.

6. The overlap between CDPs and ESPs is going to continue to complicate the selection process for brands who rush in without doing their homework. And it’s not going to get any easier any time soon!

As I wrote last year, and it’s truer than ever this year, RFPs are increasingly harder to manage successfully in a fast-changing vendor landscape populated by a number of legacy and “next gen” platforms all of whom are competing for the same business. Ongoing platform innovations, CDPs, and an increasing need for 1st party data are going to have an increasing influence on how brands perceive the various ESPs, and how the ESPs position themselves for success in the marketplace.

The stakes of getting your RFP right have never been higher. And the selection process has never been more difficult.

OI Members: Chris will be leading a discussion on this post on our March 9, 2023 OI-members-only Zoom -- watch the discussion list for the link! Not a member? Join here or reach out to Jeanne, our general manager, to learn more.

Photo by Shubham Dhage on Unsplash

Photo by Shubham Dhage on Unsplash

How to resolve AdBlock issue?

How to resolve AdBlock issue?