3 Key Takeaways from the Top 1000/Top 100 E-Tailer ESPs market share.

Last month Only Influencers hosted a webinar presenting new research from Publicare Marketing Communications GmbH on the most popular ESPs for U.S. E-retailers. Jeanne Jennings moderated, with Marion Krohn and Rober Harnischmacher from Publicare presenting their findings; I was there too, to discuss the findings. You can watch the full 1-hour webinar on-demand; in the meantime, here are my key takeaways.

Before diving into the results, I want to review how the research was conducted, because that is critical in understanding and interpreting the results.

- Base: Top 1000 largest online retailers in North America, ranked by revenue by Digital Commerce 360.

- Promotional email sign-up was carried out on the website of the retailer's primary store (store with the highest revenue, as ranked by Digital Commerce 360). Meaning Gap Inc. would count as 1 client not 4 brands (Gap, Athleta, Banana Republic, Old Navy) in tallying the results. (Had the rankings been based on email VOLUME, this would have been a huge issue)

- With the help of complex recognition logic in Publicare’s marketing database, the email headers and email source code of the emails received were analyzed and the sending platforms recognized.

- The percentage market share is calculated from the total number of companies that sent at least one email.

There are many ways to measure market share which would have produced very different results. Email volume and revenue were NOT taken into account in these results, just the total number of clients. An enterprise ESP with 2 clients in the Top 100 sending a combined 30 billion emails a year ranks below an SMB ESP with 10 clients sending a combined 1 billion emails a year. So, it would be a huge mistake to equate ranking with platform quality. That simply cannot be extrapolated from this data.

I bet you’re thinking: “OK Chris, in that case is there ANYTHING of value that we can take away from the results?!”

The answer to that is a big “YES”, and that’s what we talk about in the following paragraphs!

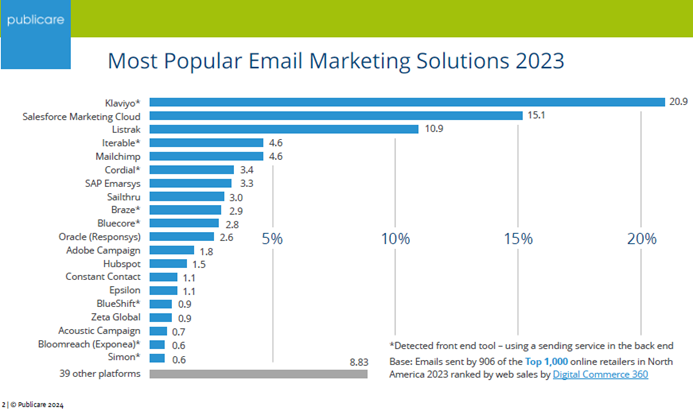

Let’s first take a look at the results of the Top 1000 e-retailers:

When you are looking at the Top 1000 online retailers you are looking at brands that vary from small-to-medium-sized (SMB) online retailers all the way up to massive brands sending billions of emails a year. Because the number of clients controls the rankings, it makes perfect sense that Klaviyo would come out on top here. In 2022, Shopify made a strategic investment in Klaviyo, and as a result it has steadily increased its client base in the SMB market, mainly at the expense of Mailchimp. Were Klaviyo not so dominant in the SMB space, we’d see a better representation of other SMB ESPs in this list. As it is, only Mailchimp and Constant Contact manage to crack the top 20.

The influence of the midmarket online retailers on the results is evidenced by Listrak’s third place showing. Being laser-beam focused on the midmarket online retailer space is paying off for the ESP, aided by Oracle’s shutting down Listrak’s biggest competitor in that space, Bronto, a few years ago.

Of course, Salesforce can’t go unmentioned, ranking as the ESP with the second largest number of clients in the Top 1000. This can be traced to the platform’s large number of clients in both the mid-market and enterprise (101-500) spaces. My prediction is that as the share of nextgen platforms continues to grow, Salesforce’s share will decline.

The number of nextgen platforms in the top 20 is proof of their growing influence. Iterable, Cordial, Marigold Engage by Sailthru, Braze, and Zeta Global all show up in the top 20, grabbing close to 15% share of the Top 1000.

However, something was bothering me about the results.

Where was Marigold Engage+ (formerly Cheetah) in the rankings? How could one of the leading enterprise retail platforms not make it to the top 20 of the Top 1000 online retailers? And here’s where differences in the ESP landscape start to matter.

In Europe, there are SMB platforms, and everyone else (which in the U.S. would typically be considered mid-market). There aren’t the huge differences in sender volume that we see in the U.S. between #1 and #1000, so the ESP line-up doesn’t change dramatically depending on how the market is cut. Suspecting the Marigold (Cheetah) mystery might be explained by this I asked to see the ESP rankings for the Top 100 online retailers. And here’s what it looks like:

As I scanned these rankings, they confirmed what I had expected to see. Klaviyo experiences a significant drop in ranking and share, and Mailchimp and Constant Contact drop off entirely. Legacy enterprise platforms dominate the list, followed closely by nextgen platforms. Marigold Engage+ (Cheetah) shows up as I expected. Not surprisingly, Salesforce and Oracle place first and second, with Adobe Campaign at #5. As I wrote regarding the Top 1000 however, the growing influence and share of the nextgen platforms is going to come at the expense of Salesforce (and Oracle, and Adobe).

But there’s another trend that is also showing up in these rankings. As I first started writing and speaking about in 2020, the growing overlap between CDPs and ESPs was going to have a major impact on the vendor landscape. And sure enough, in both the top 20 for the Top 1000 and the top 20 for the Top 100, we see deployment CDPs represented, specifically Simon and Blueshift. The success of these CDPs in winning email business has tremendous implications for both the future of ESPs and of CDPs. More and more, brands are not distinguishing between the two when determining which platforms to include in ESP RFPs. And because the closest cousins of the deployment CDPs are the nextgen platforms, the combined share of both is even more impressive.

I spent a lot of time at the beginning of this talking about the limitations of the methodology behind these rankings. But they are all we have, and they are much better than guessing who has the most clients (as opposed to who drives the most revenue). But besides gaining some valuable understanding of how the ESPs stack up customer-wise, a few other things emerge from the research that are worth point out:

- The 3 tier ESP system is alive and well in North America (SMB, mid-market, enterprise)

Very early in the days of email marketing the needs and budgets of online retailers began to diverge, leading to the development of 3 tiers of ESPs. This research shows that this platform landscape continues to hold true today.

- The “Changing of the Guard” that I first spoke about in 2021 is truly taking place. The research clearly shows that nextgen platforms continue to gain share and grow in influence at the enterprise and mid-market levels. I’m hoping this research is conducted again next year, because at this point, we can only guess from whom the nextgen platforms are taking share.

- Given the platform overlap (which I’ve been writing and talking about since 2020) Marketers in the mid-market are not making distinctions between deployment CDPs like Blueshift and Simon, and nextgen platforms like Cordial and Zeta. There’s really no reason not to include those CDPs in any discussion of nextgen platforms, and their share is going to grow as they add more features and functionality to their deployment capabilities. They’re not enterprise-ready yet. But neither was Braze a few years back.

In conclusion, there are a lot of vendors competing for market share in online retailing, in all three segments of the market. New vendors over the last 10 years are heating up the competition and putting pressure on the older legacy platforms. Making sense of the landscape isn’t easy, and casual comparisons of the platforms won’t yield meaningful insights. From the one-year snapshot we see today you can’t tell if a platform is gaining share, losing share or staying flat. Next year we’ll hopefully be able to make those calls!

How to resolve AdBlock issue?

How to resolve AdBlock issue?